Trusts

When considering any structure, you want to assess how suitable it is for your and your circumstances. Things to consider, include:

- The status of the structure in relation to income tax, capital gains tax and land tax.

- The status of the structure in relation to asset protection.

- The level of control provided by the structure and succession planning considerations.

- The flexibility to change as circumstances might dictate.

- The initial and ongoing costs associated with setting up and running the structure.

What is a Trust?

A Trust is a structure which separates the legal ownership of an asset or entity from the beneficial ownership. This is usually done to provide benefits and protections to the beneficial owners.

A trust is an obligation imposed on a person or other entity to hold property for the benefit of beneficiaries. While in legal terms a trust is a relationship not a legal entity, trusts are treated as taxpayer entities for the purposes of tax administration.

Who is a Trustee?

The Legal Owner.

The trustee is responsible for managing the trust’s tax affairs, including registering the trust in the tax system, lodging trust tax returns and paying some tax liabilities.

Who is a Beneficiary?

The person entitled to the benefit of the asset or entity.

Beneficiaries (except some minors and non-residents) include their share of the trust’s net income as income in their own tax returns. There are special rules for some types of trust including family trusts, deceased estates and super funds.

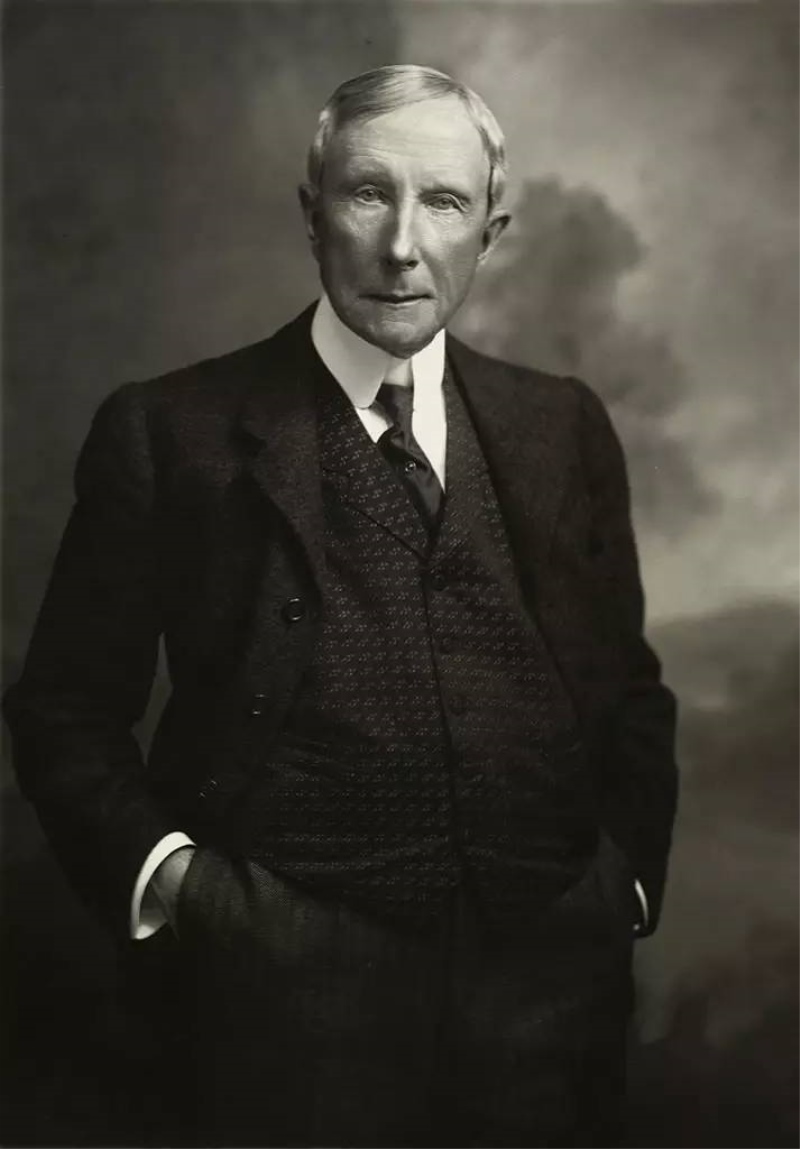

“Own nothing, but control everything”

– John D Rockefeller Sr

While the tax and legal landscape may have changed since this famous quote, there still remain significant benefits to the proper use of Trust structures for investment, business, asset and income distribution and protection purposes.

The most common types of trusts are:

− a fixed trust;

− a unit trust;

− a hybrid trust;

− a discretionary trust.

If you are considering your a Trust, your Estate Plan, asset protection or business structures, it is important that you seek appropriate legal advice, so you are aware of your rights and where you stand. Contact Carter O’Neill Legal today to speak to our Gosford lawyers on (02) 4308 8892 or our Mona Vale lawyers (02) 9171 7339 to discuss any of your legal needs.